What Can You Give Up for Financial Freedom?

For most of us, it is impossible to be prudent with money all the time. Humans are irrational when it comes to finances.

We all know that smart decisions bring long-term benefits, but taking action is not easy. If your situation is less than perfect, ask yourself this question, “What could I give up for the sake of financial freedom?”

The economy of Nigeria is in a bad shape. The impact of the pandemic is massive. As the country is so dependent on oil exports, the latest crisis is devastating.

The consequences, like soaring unemployment, are far-reaching. Millions of people wish they could improve their financial situation. Consider these tips to spend less and earn more in 2021.

1. Consider Moving House

If the utility bills or mortgage payments are too expensive, you may be better off in a cheaper and smaller apartment. Some people feel okay living in a trailer or other type of temporary home.

On the upside, limited space tempts you to spend more time outside and helps to save up for better living conditions.

2. Postpone Buying a Car

If you are planning to buy a new vehicle, ask yourself, “Is this really necessary at the moment?” Can you make the purchase without borrowing?

Also, make sure the interest rate is low. Compare maintenance of your old vehicle and the cost of a loan. Weigh up the pros and cons before signing on the dotted line.

3. Cancel Your Vacation

Some people borrow money to go on vacation. Even payday loans — the most expensive loans on the market — are used for this purpose.

This is reckless and dangerous. If you desperately want to go on holiday, pick a cheaper location or stay in your town. Overall, vacation on borrowed money is a terrible idea.

Why not earn more instead? Consider alternative jobs — part-time or full-time. For example, if you know what is Forex and how it works, you could make extra money from any computer or smartphone.

For some people, their passion for markets turns into a lifelong career. Brokers like Forextime make trading easily accessible.

4. Why Buy More Clothes?

Today, online shopping is so easily accessible that not splurging is a challenge. In the past, the solution was simple — you would avoid walking into the stores.

When accompanying a friend on their shopping spree, fighting the urge is next to impossible. Eventually, you will buy something. If clothes are your passion, this is a big problem. So, what should you do?

Every month, you may allow yourself a bit of fun money. A portion of the sum may be spent on clothes. When the budget is limited, you are less likely to buy unnecessary items.

Secondly, look for bargains only. What is the point of paying the full price now when the product will eventually become cheaper?

Do not fall victim to shopping. New purchases make you feel good, but this feeling is only fleeting. Prioritize financial growth over instant gratification.

If you spend money to boost confidence, there must be another solution. What are the true reasons for your insecurity?

5. Choose Cheaper Hobbies

Some hobbies are pricey. For example, gun collection, hunting, horseback riding or four-wheeler racing are all expensive in comparison with reading or writing. Think about all of the equipment you need!

Even bikes could be costly. Some people are willing to spend $12,000 on a top model. What is the point if your bike is just a way for you to get exercise?

Think about the utilitarian value. Showing off is expensive and unnecessary.

The Bottom Line

People who want to improve their finances do not have to give up all the fun. Still, some of life's luxuries are less important than we think.

Modern budgeting apps will help you break down the monthly spending and see which things are the priciest.

Can you switch to a cheaper model or service to bring the costs down? Are some of your expenditures unnecessary?

However, cutting costs is just the first part of the equation. It is also necessary to earn more. Fortunately, modern ways to make money, such as Forex, allow us to boost income.

They may become an addition to your regular job. Later, you could devote all of your time to Forex trading. The benefits are clear.

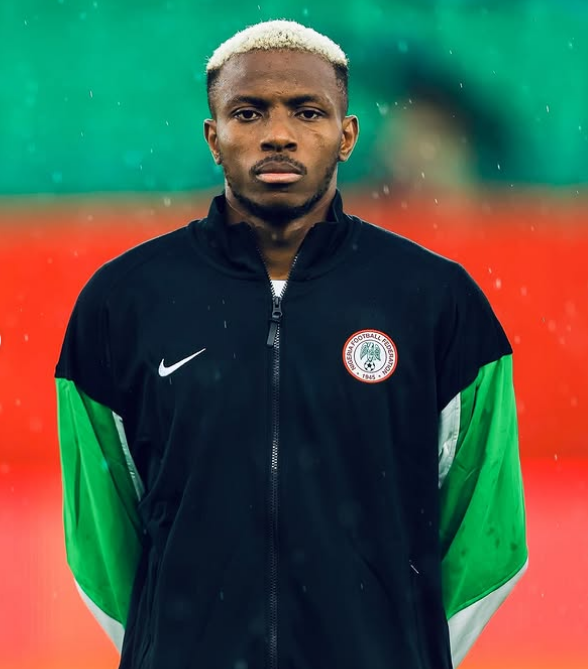

Ifeanyi Emmanuel

We all know that smart decisions bring long-term benefits, but taking action is not easy. If your situation is less than perfect, ask yourself this question, “What could I give up for the sake of financial freedom?”

The economy of Nigeria is in a bad shape. The impact of the pandemic is massive. As the country is so dependent on oil exports, the latest crisis is devastating.

The consequences, like soaring unemployment, are far-reaching. Millions of people wish they could improve their financial situation. Consider these tips to spend less and earn more in 2021.

1. Consider Moving House

If the utility bills or mortgage payments are too expensive, you may be better off in a cheaper and smaller apartment. Some people feel okay living in a trailer or other type of temporary home.

On the upside, limited space tempts you to spend more time outside and helps to save up for better living conditions.

2. Postpone Buying a Car

If you are planning to buy a new vehicle, ask yourself, “Is this really necessary at the moment?” Can you make the purchase without borrowing?

Also, make sure the interest rate is low. Compare maintenance of your old vehicle and the cost of a loan. Weigh up the pros and cons before signing on the dotted line.

3. Cancel Your Vacation

Some people borrow money to go on vacation. Even payday loans — the most expensive loans on the market — are used for this purpose.

This is reckless and dangerous. If you desperately want to go on holiday, pick a cheaper location or stay in your town. Overall, vacation on borrowed money is a terrible idea.

Why not earn more instead? Consider alternative jobs — part-time or full-time. For example, if you know what is Forex and how it works, you could make extra money from any computer or smartphone.

For some people, their passion for markets turns into a lifelong career. Brokers like Forextime make trading easily accessible.

4. Why Buy More Clothes?

Today, online shopping is so easily accessible that not splurging is a challenge. In the past, the solution was simple — you would avoid walking into the stores.

When accompanying a friend on their shopping spree, fighting the urge is next to impossible. Eventually, you will buy something. If clothes are your passion, this is a big problem. So, what should you do?

Every month, you may allow yourself a bit of fun money. A portion of the sum may be spent on clothes. When the budget is limited, you are less likely to buy unnecessary items.

Secondly, look for bargains only. What is the point of paying the full price now when the product will eventually become cheaper?

Do not fall victim to shopping. New purchases make you feel good, but this feeling is only fleeting. Prioritize financial growth over instant gratification.

If you spend money to boost confidence, there must be another solution. What are the true reasons for your insecurity?

5. Choose Cheaper Hobbies

Some hobbies are pricey. For example, gun collection, hunting, horseback riding or four-wheeler racing are all expensive in comparison with reading or writing. Think about all of the equipment you need!

Even bikes could be costly. Some people are willing to spend $12,000 on a top model. What is the point if your bike is just a way for you to get exercise?

Think about the utilitarian value. Showing off is expensive and unnecessary.

The Bottom Line

People who want to improve their finances do not have to give up all the fun. Still, some of life's luxuries are less important than we think.

Modern budgeting apps will help you break down the monthly spending and see which things are the priciest.

Can you switch to a cheaper model or service to bring the costs down? Are some of your expenditures unnecessary?

However, cutting costs is just the first part of the equation. It is also necessary to earn more. Fortunately, modern ways to make money, such as Forex, allow us to boost income.

They may become an addition to your regular job. Later, you could devote all of your time to Forex trading. The benefits are clear.

Ifeanyi Emmanuel

Comments 0

Leave a Comment

No comments yet. Be the first to comment!